Running a small business in Canada is no easy feat, and managing payroll can be a particularly time-consuming and complex task.

But don’t worry, there’s good news!

Several free payroll software options can help streamline the process, ensuring accuracy and compliance with Canadian regulations.

This blog post explores six of the best free payroll software solutions available, comparing their features, pricing structures, user reviews, integrations, and customer support options to help you make an informed decision.

To compile this information, we conducted thorough research, examining various payroll software options available in Canada.

We narrowed down the list based on factors such as features, user reviews, and ease of use, ultimately selecting the top six options for this blog post.

We then looked deeper into each software, gathering information on their pricing, features, integrations, and customer support options.

1. Wagepoint

Wagepoint is a cloud-based payroll software in Canada designed with small businesses in mind.

It’s known for its user-friendly interface and helpful customer support, making it a great option for those new to payroll processing.

Wagepoint automates many of the tedious tasks associated with payroll, such as calculating wages and remitting taxes, allowing you to focus on other aspects of your business.

Features

Wagepoint offers a variety of features to simplify payroll management:

- Automated tax calculations and filings: Wagepoint automatically calculates and files your federal and provincial taxes, including income tax, Employment Insurance (EI), and Canada Pension Plan (CPP).

- Direct deposit: Pay your employees directly into their bank accounts, eliminating the need for paper checks.

- Online pay stubs: Employees can easily access their pay stubs online through a secure employee portal.

- Records of Employment (ROEs): Generate and submit ROEs electronically.

- Employee self-onboarding: New hires can enter their personal and banking information themselves, saving you time and effort.

- Payroll calendar: Stay organized and on top of deadlines with Wagepoint’s in-app payroll calendar, which takes into account bank holidays and accommodates changes in pay dates.

- Hours import: Easily import approved hours from time-tracking applications like 7shifts, TSheets, and Deputy.

- Custom user roles: Assign different levels of access to employees based on their roles and responsibilities.

- Auto-run feature: Automate payroll runs for salaried employees with consistent pay.

Pricing

Wagepoint offers two simple pricing plans:

- Solo: $20/month + $4 per employee/contractor. This plan is perfect for businesses that run payroll once a month and have one pay group.

- Unlimited: $40/month + $5 per employee/contractor. This plan is ideal for businesses that handle multiple payrolls in a month and have multiple pay groups.

Both plans include all core features, such as direct deposit, tax remittances, and year-end reporting.

User Reviews and Ratings

Wagepoint consistently receives positive feedback from users, with an average rating of 4.7 out of 5 stars on Capterra. Users appreciate its user-friendly interface, excellent customer support, and accurate tax calculations. Some users have suggested improvements to the reporting features and integration with other business tools.

Integrations

Wagepoint integrates with popular accounting software like QuickBooks Online and Xero, allowing for seamless data transfer between platforms. It also integrates with time-tracking applications such as 7shifts, TSheets, and Deputy.

Customer Support

Wagepoint is known for its friendly and responsive customer support team. Users can access support through various channels, including:

- In-app help button: Access relevant help articles and submit support tickets directly within the app.

- Phone: Speak to a support representative by calling 1-877-757-2272.

- Email: Send an email to the support team.

- Knowledge Base: Access a comprehensive library of help articles and FAQs.

- Wagepoint Academy: Access online courses and webinars on payroll topics.

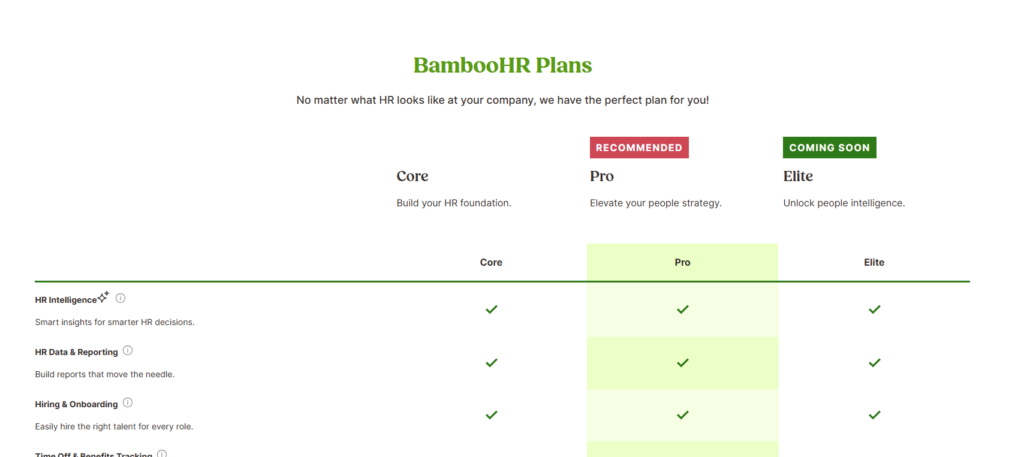

2. BambooHR

BambooHR is a comprehensive HR platform that offers a variety of features, including an Applicant Tracking System (ATS), onboarding tools, payroll, time tracking, benefits administration, performance management, employee wellbeing tools, and an employee community.

It’s designed to streamline HR processes, improve employee engagement, and help small businesses manage their HR needs effectively.

Features

BambooHR offers a wide range of features to manage various aspects of HR:

- Applicant Tracking System (ATS): Streamline your hiring process with tools for posting jobs, tracking candidates, and managing applications.

- Onboarding: Create a smooth onboarding experience for new hires with automated workflows and checklists.

- Payroll: Process payroll, calculate taxes, and file year-end reports with BambooHR’s payroll add-on.

- Time Tracking: Track employee hours, manage timesheets, and calculate overtime.

- Benefits Administration: Manage employee benefits, including health insurance and retirement plans.

- Performance Management: Conduct performance reviews, track goals, and provide feedback.

- Employee Wellbeing: Gather feedback and measure employee satisfaction with surveys and tools.

- Employee Community: Foster communication and collaboration among employees.

Pricing

BambooHR does not publicly disclose its pricing.

However, it is known that they charge a flat monthly rate for companies with 25 or fewer employees and a per-employee, per-month basis for larger companies. Volume discounts are available for larger companies.

User Reviews and Ratings

BambooHR has an average rating of 4.6 out of 5 stars on GetApp. Users appreciate its comprehensive features, user-friendly interface, and good customer support. Some users have mentioned limitations in customization options and occasional bugs in the system.

Integrations

BambooHR integrates with a wide range of third-party applications, including popular payroll providers, job boards, and time-tracking systems. It also offers an open API for custom integrations.

Customer Support

BambooHR provides customer support through various channels:

- Phone: Call 1-866-387-9595 to speak to a support representative.

- Email: Send an email to [email protected].

- Live Chat: Chat with a support representative online during business hours.

- Help Center: Access a library of help articles and FAQs.

3. QuickBooks Online

QuickBooks Online is a well-known cloud-based accounting software in Canada that also offers payroll features as an add-on. It allows you to manage all your financial data in one central location, including income, expenses, and payroll. QuickBooks Online is a good option for small businesses that want an integrated accounting and payroll solution.

Features

QuickBooks Online offers a wide range of features for small businesses:

- Invoicing: Create and send professional invoices, track payments, and manage receivables.

- Expense Tracking: Track and categorize expenses, capture receipts, and manage bills.

- Bank Reconciliation: Reconcile bank accounts, import transactions, and track cash flow.

- Payroll: Pay employees, calculate taxes, and file year-end reports with the QuickBooks Payroll add-on.

- Reporting: Generate various financial reports, including profit and loss statements and balance sheets.

- Tax Preparation: Organize financial data and generate reports for tax season.

- Mobile App: Access and manage your finances on the go.

Pricing

QuickBooks Online offers four pricing plans:

- EasyStart: $6/month. This plan is suitable for freelancers and new businesses with basic needs.

- Essentials: $27/month. This plan offers more features, including bill management and time tracking.

- Plus: $32/month. This plan is the most popular and includes inventory management and project profitability tracking.

- Advanced: $64/month. This plan is designed for larger businesses and includes advanced features like custom reporting fields and workflow automation.

User Reviews and Ratings

QuickBooks Online has an average rating of 4.3 out of 5 stars on GetApp. Users appreciate its comprehensive features, ease of use, and good customer support. Some users have mentioned that it can be expensive and may have a learning curve for those unfamiliar with accounting principles.

Integrations

QuickBooks Online integrates with over 750 popular business apps, including those for payment processing, e-commerce, inventory management, and CRM.

Customer Support

QuickBooks Online offers customer support through various channels:

- Phone: Call 1-888-829-8589 to speak to a support representative.

- Live Chat: Chat with a support representative online.

- Community: Ask questions and get help from other QuickBooks users in the online community forum.

- Help Center: Access a library of help articles and FAQs.

4. Gusto

Gusto is an all-in-one HR platform designed to help growing businesses manage their HR needs in one place. It offers a wide range of features, including payroll, benefits, hiring and onboarding tools, time tracking, an HR resource center, compliance alerts, and employee self-service options. Gusto is a good option for small businesses that want a comprehensive HR solution with modern features.

Features

Gusto offers a wide range of features to manage various aspects of HR:

- Payroll: Process payroll, calculate taxes, and file year-end reports.

- Benefits: Offer health insurance, 401(k) plans, and other benefits to your employees.

- Hiring and Onboarding: Find, hire, and onboard new employees with tools for job posting, applicant tracking, and onboarding checklists.

- Time Tracking: Track employee hours, manage timesheets, and calculate overtime.

- HR Resource Center: Access resources and tools for managing HR tasks, such as creating job descriptions and employee handbooks.

- Compliance Alerts: Stay up-to-date on changes in state or federal labor laws.

- Employee Self-Service: Empower employees to manage their own information and access pay stubs and tax forms.

Pricing

Gusto offers three pricing plans:

- Simple: $49/month + $6/month per person. This plan is best for new businesses and startups paying people in one state.

- Plus: $60/month + $9/month per person. This plan includes features for multi-state payroll, time tracking, and HR tools.

- Premium: $135/month + $16.50/month per person. This plan is for larger businesses and includes a dedicated customer success manager and access to certified HR experts.

User Reviews and Ratings

Gusto has an average rating of 4.6 out of 5 stars on GetApp. Users appreciate its ease of use, comprehensive features, and good customer support. Some users have mentioned issues with the FSA platform and occasional delays in payment processing.

Integrations

Gusto integrates with a wide range of third-party applications, including popular accounting software, time tracking tools, and HR platforms. It also offers provisioning apps for automatically creating and removing employee accounts for software like Zoom and Slack.

Customer Support

Gusto offers customer support through various channels:

- Phone: Call (800) 936-0383 to speak to a support representative.

- Email: Send an email to the support team.

- Chat: Chat with a support representative online during business hours.

- Help Center: Access a library of help articles and FAQs.

5. Patriot Payroll

Patriot Payroll is a cloud-based payroll software that offers both basic and full-service payroll options. It’s designed to be affordable and easy to use, making it a good choice for small businesses with limited budgets. Patriot Payroll allows you to manage payroll in three simple steps: enter hours, approve payroll, and print paychecks.

Features

Patriot Payroll offers a variety of features to simplify payroll management:

- Free direct deposit: Pay employees directly into their bank accounts with no transaction fees.

- Unlimited payrolls: Run payroll as often as you need without incurring extra charges.

- Accurate tax calculations: Patriot Payroll automatically calculates federal, state, and local taxes.

- Free employee portal: Provide employees with secure access to their pay stubs, pay history, and W-2s.

- Time-off accruals: Automate PTO calculations based on your company’s policy.

- Multiple pay rates: Support employees with different pay rates for different roles or tasks.

- HR Center: Access HR resources and tools, such as an HR assessment and compliance alerts.

- 1099 contractor payments: Process payments for both employees and contractors.

Pricing

Patriot Payroll offers two pricing plans:

- Basic Payroll: $17/month + $4 per employee/contractor. This plan allows you to run payroll and handle tax filings yourself.

- Full-Service Payroll: $37/month + $4 per employee/contractor. This plan handles tax filings and payments on your behalf.

Both plans include unlimited payrolls, free direct deposit, and a free employee portal.

User Reviews and Ratings

Patriot Payroll has an average rating of 4.8 out of 5 stars on GetApp. Users appreciate its affordability, ease of use, and excellent customer support. Some users have mentioned limitations in functionality compared to more comprehensive payroll solutions.

Integrations

Patriot Payroll integrates with its own accounting software, Patriot Accounting, for seamless data transfer between platforms. It also integrates with QuickBooks Online.

Customer Support

Patriot Payroll offers free, USA-based customer support through various channels:

- Phone: Call 877-968-7147 to speak to a support representative.

- Email: Send an email to [email protected].

- Chat: Chat with a support representative online during business hours.

- Help Center: Access a library of help articles and FAQs.

6. Xero

Xero is a cloud-based accounting software in Canada that includes payroll features through its integration with Gusto.

It’s designed for small businesses and accountants, offering a user-friendly interface and a wide range of features to manage finances. Xero is a good option for businesses that want an integrated accounting and payroll solution with strong international capabilities.

Features

Xero offers a comprehensive suite of features for small businesses:

- Invoicing: Create and send professional invoices, track payments, and manage receivables.

- Bank Reconciliation: Reconcile bank accounts, import transactions, and track cash flow.

- Expense Management: Track and categorize expenses, claim mileage, and manage bills.

- Payroll: Pay employees, calculate taxes, and file year-end reports through Gusto.

- Reporting: Generate various financial reports, including profit and loss statements and balance sheets.

- Inventory Management: Track stock levels, manage orders, and get insights into sales.

- Multi-currency accounting: Manage finances in multiple currencies.

- Mobile App: Access and manage your finances on the go.

Pricing

Xero offers five pricing plans in Canada:

- Ledger: $5/month. This plan is for businesses that need basic bookkeeping functionalities and are not registered for GST/HST.

- Cashbook: $12/month. This plan is for freelancers and small businesses with basic needs.

- Starter: $25/month. This plan includes more features, such as sending invoices and quotes.

- Standard: $55/month. This plan is suitable for growing businesses and includes bulk reconciliation and bills.

- Premium: $75/month. This plan is designed for larger businesses and includes multiple currencies and project tracking.

User Reviews and Ratings

Xero has an average rating of 4.4 out of 5 stars on GetApp. Users appreciate its user-friendly interface, comprehensive features, and strong international capabilities. Some users have mentioned limitations in customization options and reporting features.

Integrations

Xero integrates with a wide range of third-party applications, including those for e-commerce, payment processing, and CRM. It also offers an open API for custom integrations.

Customer Support

Xero offers customer support through various channels:

- Online Support: Submit support tickets online through Xero Central.

- Xero Central: Access a library of help articles, FAQs, and community forums.

- Email: Send an email to the support team.

Read also: Best Facebook Business Groups in Canada

7. BatchTransfer by Wise

BatchTransfer is a free payroll software offered by Wise, a financial technology company specializing in international money transfers. It’s a great option for businesses with employees or contractors in different countries, as it allows you to make multiple payments in one go at the mid-market exchange rate.

Features

BatchTransfer offers several features that make international payroll easy and efficient:

- Multiple payments in one go: Pay up to 1,000 employees or contractors with a single click.

- Mid-market exchange rate: Get a fair and transparent exchange rate when making international payments.

- Extensive coverage: Send payments to over 160 countries in 40+ currencies.

- Automatic payment scheduling: Schedule payments in advance to ensure timely payouts.

- API integration: Connect BatchTransfer to your accounting software for easy reconciliation.

Pricing

BatchTransfer is free to use for Wise Business account holders. Wise Business accounts have no monthly fees or minimum balance requirements.

User Reviews and Ratings

While specific user reviews for BatchTransfer are limited, Wise consistently receives positive feedback for its international money transfer services, with an emphasis on transparency and cost-effectiveness.

Integrations

BatchTransfer integrates with accounting software like QuickBooks and Xero.

Customer Support

Wise offers customer support through its website and help center.

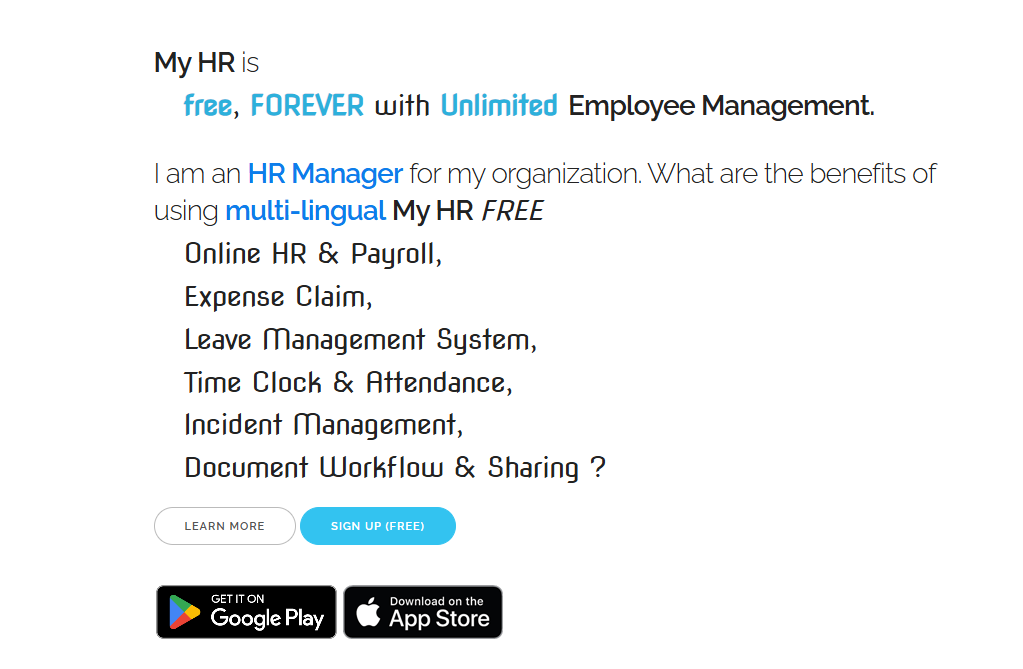

8. HR.my

HR.my is a completely free, omnichannel employee management software funded by community donations.

It’s a good option for businesses looking for a free, forever solution that can be accessed from any device.

Features

HR.my offers a variety of features to manage HR tasks:

- Payroll: Process payroll, calculate taxes, and generate reports.

- Expense claim management: Track and manage employee expense claims.

- Attendance tracking: Monitor employee attendance and absences.

- Incident reporting: Record and manage workplace incidents.

- Employee discussion boards and forums: Facilitate communication and collaboration among employees.

Pricing

HR.my is completely free to use, with full functionality available without any charges.

User Reviews and Ratings

While specific user reviews for HR.my are limited, it is a community-funded project with a focus on providing free HR solutions.

Integrations

Information on integrations with other software is not available.

Customer Support

HR.my offers customer support through its website and community forum.

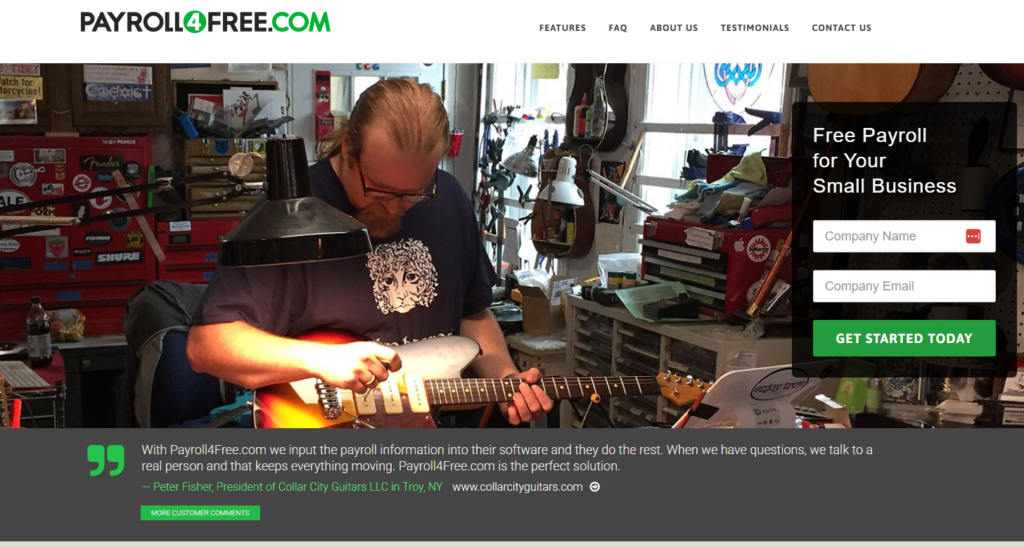

9. Payroll4Free.com

Payroll4Free.com is a free payroll software with no fees.

It’s a good option for small teams with up to 10 employees.

The software is supported by ads, which is how it remains free for users.

Features

Payroll4Free.com offers a range of features to manage payroll:

- Payroll processing: Calculate wages, withhold taxes, and generate paychecks.

- Tax calculations and forms: Calculate and file payroll taxes.

- Vacation tracking: Track employee vacation time.

- Employee portal: Provide employees with access to their pay stubs and other payroll documents.

Pricing

Payroll4Free.com is completely free to use for businesses with up to 10 employees.

User Reviews and Ratings

While specific user reviews for Payroll4Free.com are limited, it is a free payroll program with a focus on simplicity and affordability.

Integrations

Information on integrations with other software is not available.

Customer Support

Payroll4Free.com offers customer support through its website and email.

Read also: How to Do Payroll for Small Business Canada: A Complete Guide

Final Thought

Choosing the right free payroll software can significantly impact your small business’s efficiency and compliance.

Each of the nine options discussed in this blog post offers unique features and benefits.

When making your decision, consider factors such as your business size, the complexity of your payroll needs, your budget, and the level of customer support you require.

Here’s a quick comparison table of best free payroll software to help you make an informed decision:

| Feature | Wagepoint | BambooHR | QuickBooks Online | Gusto | Patriot Payroll | Xero | BatchTransfer | HR.my | Payroll4Free.com |

|---|---|---|---|---|---|---|---|---|---|

| Primary Focus | Payroll | HR Management | Accounting & Payroll | HR & Payroll | Payroll | Accounting & Payroll | International Payroll | HR Management | Payroll |

| Free Plan | No, but offers a free trial | No | No | No | No | No, but offers a free trial | Yes | Yes | Yes, for up to 10 employees |

| Pricing | Subscription + per employee | Flat monthly rate (up to 25 employees); per employee (over 25 employees) | Subscription | Subscription + per employee | Subscription + per employee | Subscription | Free for Wise Business account holders | Free | Free |

| Tax Filing | Automated | Automated with add-on | Automated with add-on | Automated | Automated with Full-Service plan | Automated | N/A | Automated | Automated |

| Direct Deposit | Yes | Yes, with add-on | Yes, with add-on | Yes | Yes | Yes, through Gusto | Yes | Yes | Yes |

| Ease of Use | High | High | Medium | High | High | High | High | Medium | High |

| Customer Support Rating | Excellent | Good | Good | Good | Excellent | Good | Good | N/A | N/A |

| Key Strengths | User-friendly, great for small businesses | Comprehensive HR features | Integrated accounting and payroll | Modern HR features, good for growing businesses | Affordable, easy to use | Strong international capabilities | Free, good for international payments | Free, forever solution | Free, good for small teams |

| Key Weaknesses | Limited integrations | Limited customization, occasional bugs | Can be expensive, learning curve | Issues with FSA platform | Limited functionality | Limited customization, reporting features | Limited functionality | Limited information available | Limited functionality, employee limit |

Ultimately, the best free payroll software for your small business depends on your specific needs and priorities.

We encourage you to explore the options further, try out free trials, and read user reviews to make the best choice for your business.

Read also:

Web HostingAffordable Canadian web hosting, user-friendly and reliable.

Web HostingAffordable Canadian web hosting, user-friendly and reliable. WordPress HostingFast, reliable WordPress hosting in Canada. Perfect for blogs and businesses.

WordPress HostingFast, reliable WordPress hosting in Canada. Perfect for blogs and businesses. Email HostingCreate branded email accounts with simple, affordable email hosting.

Email HostingCreate branded email accounts with simple, affordable email hosting. Reseller HostingStart your own hosting business with flexible reseller hosting plans.

Reseller HostingStart your own hosting business with flexible reseller hosting plans. Affiliate ProgramJoin our affiliate program and earn commissions by referring customers.

Affiliate ProgramJoin our affiliate program and earn commissions by referring customers. DomainsFind the perfect domain for your business or personal site with ease.

DomainsFind the perfect domain for your business or personal site with ease. Domain TransferTransfer your domain to us and keep your website running without interruption.

Domain TransferTransfer your domain to us and keep your website running without interruption. WHOIS LookupQuickly find who owns a domain with our easy WHOIS search tool.

WHOIS LookupQuickly find who owns a domain with our easy WHOIS search tool. VPS HostingReliable VPS hosting crafted for performance and peace of mind.

VPS HostingReliable VPS hosting crafted for performance and peace of mind. Managed VPSNo technical skills? Let us manage your VPS for you.

Managed VPSNo technical skills? Let us manage your VPS for you.